As consumer prices continue their upward march, more Americans are cutting back on spending any way they can. They plan to ditch dining out — especially for breakfast and lunch — avoid the coffee shop and even skip meals to save money.

That’s according to the latest results from the Advantage 2024 Shopper Outlook survey, which polled more than 8,000 U.S. grocery shoppers in late 2023 and offers a barometer of how consumers are shopping in the first half of 2024.

Shifting habits among Americans, particularly those pinched by the effect of a prolonged period of rising consumer prices, present opportunities for brands and retailers to adjust their offerings, increase promotions and amp up social media marketing campaigns to meet evolving consumer demand.

Pressure on consumers shows little sign of abating — consumer prices jumped 3.5% again in March, a figure higher than economists expected — raising the specter that Americans who were already planning to adjust their behavior due to inflation will take even starker measures to make ends meet.

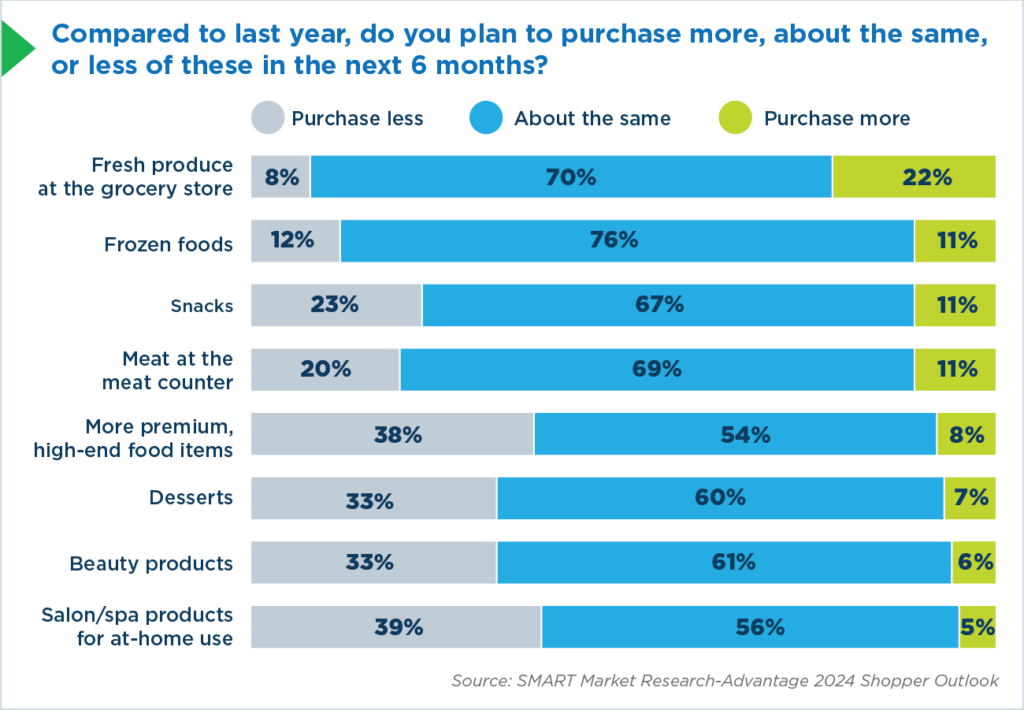

Some 16% of survey participants said they plan to have more meals at home over the next six months, according to the survey. Instead, these consumers “plan to purchase more in categories such as fresh produce, snacks, meat purchased at the meat counter and frozen foods,” says Jill Blanchard, president of enterprise client solutions at Advantage Solutions.

What can retailers do?

That opens the door for brands and retailers to offer more convenient meal solutions and augment their social media and marketing campaigns with menu suggestions designed to save consumers money, she says.

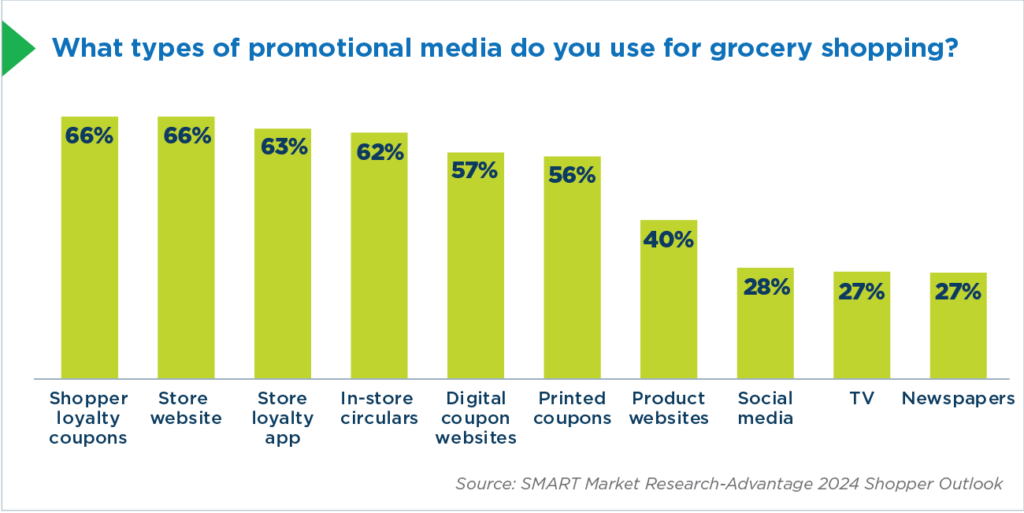

Grocery shoppers of all income levels and demographic groups want value, and they’re increasingly turning to retail promotional media platforms to find it.

According to the survey, two-thirds of consumers use shopper loyalty coupons and more than half (53%) visit retailer websites before going to a store. Consumers are also leaning heavily on store loyalty apps (63%), in-store circulars (62%), digital coupon websites (57%) and printed coupons (56%).

Promotional media use varies by generation, and brands and retailers must adapt and market accordingly. For instance, Gen Z is most likely to use social media and websites and less likely to use in-store circulars, newspapers or printed coupons. On the other hand, 70% of Boomers use in-store circulars. Millennials engage with promotional media of all types.

By the numbers

It’s also critical to understand what shoppers are buying – and not buying. Shoppers are saying no to premium, high-end food items (38%), desserts (33%) and beauty products (33%), in favor of essentials.

Similarly, a growing percentage of consumers plan to cut back on dining out for breakfast (44%) and lunch (39%), and even picking up coffee from local shops (39%). Spas and salons may have some downtime soon too: Nearly half of consumers (45%) plan to spend less there in the next six months.

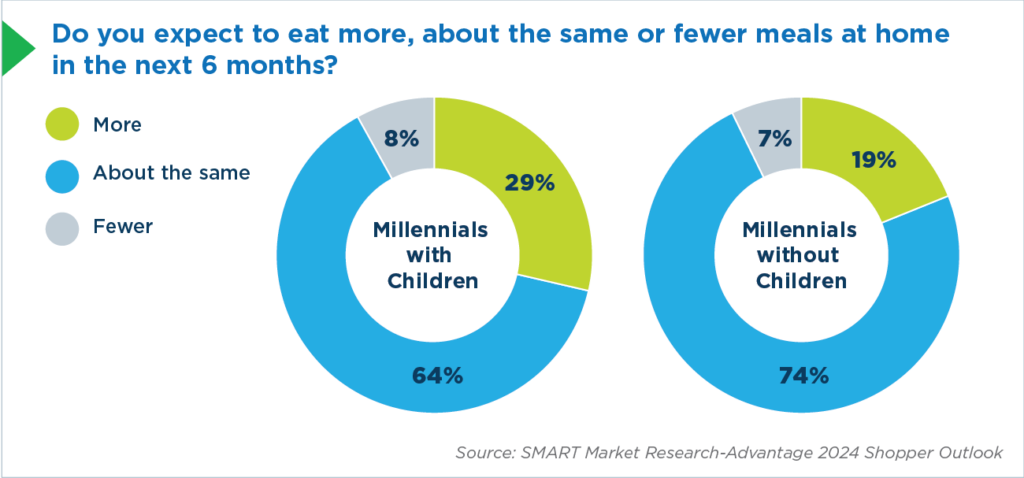

Millennials, who make up the largest percentage of adult Americans, are feeling the pinch hard, particularly those with children. Some 29% of Millennials with children plan to cut back on dining out, while 19% of those without children also plan to eat at home more.

Not surprisingly, those most impacted by inflation are households with annual incomes less than $50,000. These consumers spend a disproportionate amount of their money on groceries and have little disposable income.

“We see this group switching to lower-priced brands or less expensive options, or cutting back on how much they buy on their weekly shopping trips,” Blanchard says.

There are also other external influences impacting how Americans shop for groceries.

The reduction of SNAP benefits and the rolling back of student loan forgiveness have affected about 20% of households, who say they will lower how much they spend on groceries and non-essential purchases. Among lower-income shoppers, one in three have been impacted by the loss of SNAP benefits.

Other findings from the survey include:

- Lower-income households are 50% more likely than the average shopper to skip meals to save money.

- Consumers in the South Central parts of the United States are feeling the most impact from inflation due to the higher percentage of lower-income households. The Pacific region, New England and the Mid-Atlantic states have been less affected by inflation.

- Dinner is the meal most commonly eaten at home, with an average of 5.62 times per week. Americans eat breakfast at home an average 4.92 times per week, followed by lunch at 4.5 times per week.

The Advantage 2024 Shopper Outlook was sponsored by Advantage Customer Experience; Ajinomoto; Pete & Gerry’s; RIOT Energy; StarKist; Daisy Brand; Musco Food Corp.; The Krusteaz Company; Reynolds Consumer Products; Upfield; and Utz Brands.