If you’re like 95% of Americans, you have private brand products in your pantry or cupboard. At a time when almost half of consumers report struggling to make ends meet, private brands present an intriguing mix of value and innovation, growing at a unit-rate six times that of national brands. The latest Private Brand Intelligence Report from Advantage360 shows how leading retailers are turning private brands into powerhouses of growth and differentiation.

Regulation and Reformulation

Starting with a ban on Red Dye #3 in January, the U.S. Department of Health and Human Services and FDA have turned up the heat on potential regulations and restrictions on everything from seed oils and artificial dyes to ultra-processed foods.

This new approach coincides with increased consumer demand for clean-label ingredients and greater transparency in what they purchase.

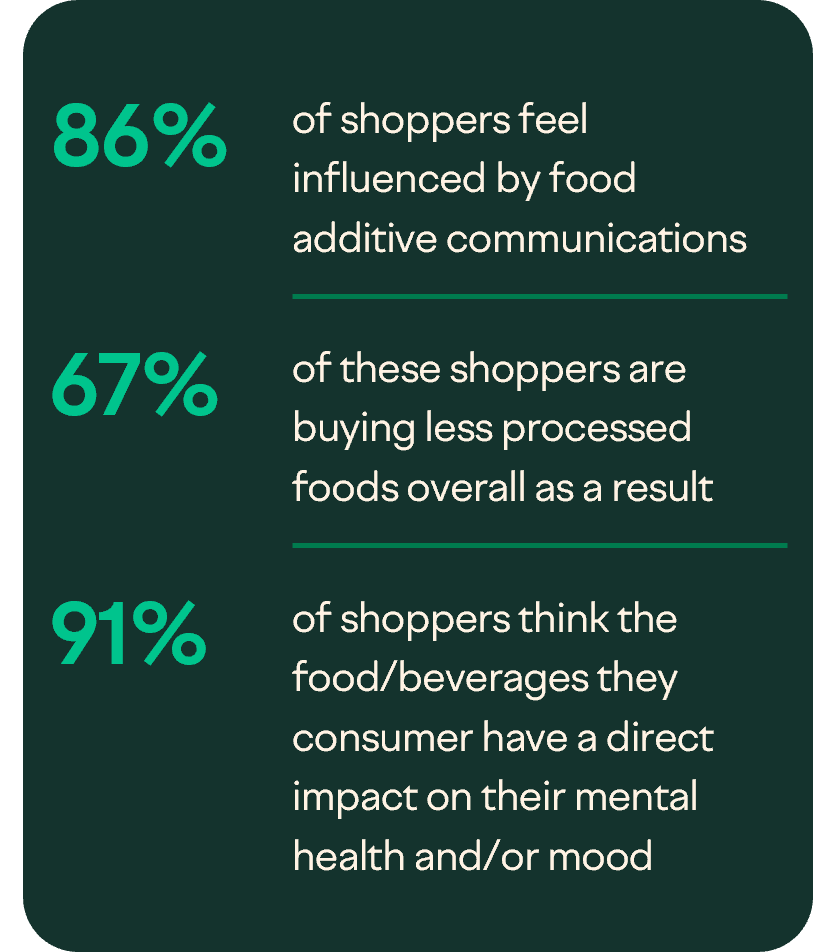

While eliminating synthetic dyes is a significant concern, it’s only part of a larger mindset that consumers are adopting around the need to cut out harmful or artificial ingredients. According to the Private Brand Intelligence Report, almost 9 in 10 shoppers feel influenced by food additive communications, a majority of which are buying less processed foods overall as a result.

Catching up to Consumer Demand

With more than a dozen regulations up for discussion, the U.S. largely lags behind the European Union where many additives are already illegal or require a mandatory warning label. Retailers can stay ahead of the curve by proactively integrating reformulation into their brand strategy to build greater loyalty among shoppers and drive sales.

Although many of the proposed regulations won’t take effect until 2026, retailers need to start setting a strategy around their program immediately. Are they getting ahead of regulations or just addressing the current guidance? Are they looking to push their entire portfolio or just specific brands? If they are reformulating, which ingredients need to go? Answering questions like these early will help retailers begin working with manufacturers and across the supply chain, both of which are expected to endure a heavy strain as more products begin large-scale reformulation.

Being able to quickly identify affected SKUs is essential as the regulatory environment remains in flux. With retailers potentially having thousands of items in their portfolios, digitizing product information and utilizing tech platforms to provide comprehensive, up-to-date product specs provides the flexibility to quickly query information, reduce risk and respond accordingly.

Simple Swap VS Having to Start from Scratch

While technology can identify which items are ripe for reformulation, different paths carry different considerations.

Replacing a synthetic ingredient with a more natural one is a great outcome, but a one-to-one replacement is rarely an option. More likely, a benchtop reformulation or scale-up trial will be needed to ensure that the taste, texture and color remain consistent.

If a simple swap isn’t possible, retailers may need to implement an out-of-the-box solution to avoid discontinuing the item entirely. This distinctive product process can yield a truly differentiated item and a trusted supplier is an important ingredient in bringing something entirely new to market.

“Vetting suppliers and having an understanding of both their capabilities as well as their willingness to innovate is essential as brands race to reformulate their products in ways big and small,” said Jim Griffin, president of Daymon North America. “With over 37,000 global suppliers in our Product Hub, we know with a great deal of certainty who will be able to help you execute on your objectives and bring the best version of your product to market.”

Consumers need Clear Communication

Whether it’s a simple ingredient swap or a new product started from scratch, on-pack considerations like key callouts and claims will carry more weight, especially if there is a price increase. Retailers can also help consumers understand changes with off-pack marketing on platforms ranging from store apps, display pages on websites and even through social media. Strategically utilizing promotions and optimizing placement are also crucial to retaining loyalty, as these actions minimize the feeling of disruption for the shopper and maximize the impact of product improvements.

“Having a clear strategy to address reformulation is essential because it’s not a matter of if new regulations will roll out, but when and how fast can you respond,” said Jean Ryan, VP of strategic advisory for Daymon. “Having to change suppliers or completely start a new product from scratch is an investment but we can help you transform this disruptive moment into a competitive advantage.”

Interested in exciting consumers with seasonal flavors, driving loyalty through distinctive product development, and navigating increasingly blurred brand tiers with confidence? Learn more about how Daymon is turning insights into innovation by downloading the Advantage360 Private Brand Intelligence Report.