Are rising prices slowing online grocery growth, or just changing how we shop? Online & Mobile Use, the final installment of the Advantage360TM Shopper Study, reveals who’s shopping online, what drives their choices, and how retailers can better connect with them.

Online and Mobile offers quality and convenience

Are you primarily a food or specialty retailer? Are you a brand looking to compete in those channels? If so, there’s a better than average chance your key audience has made an online purchase within the past six months. The Shopper Study found that these two groups have the highest occurrence of online shoppers regardless of age, geography or other demographic factors. Conversely, at almost 10 points below the average, discount and mass shoppers had the lowest adoption.

What’s driving this discrepancy? In general, shoppers who buy food online are looking for quality. While price is still a consideration, their priority is finding the products they want quickly and easily. This is especially true for hard-to-find items.

“People are busier than ever, so not having to physically go to a store is a nice alternative and a huge time saver,” explains Nico Cattaneo, Head of Analytics & Insights at Advantage Solutions. “More and more, we’re seeing shoppers gravitate to online retailers that can provide a one-stop-shop for grocery needs. Building up that online presence, especially the store website, is a good investment for retailers looking to connect.”

Back to Brick?

Although the majority of shoppers—around 3 in 4—indicate that they will maintain their current level of online shopping, many are changing their habits in the face of rising prices and competition from brick-and-mortar retailers.

Across categories, pet food and supplies is expected to see the largest net decline, followed by beauty products and food. While not as pronounced, other categories such as health and wellness, personal care and non-food grocery are also showing a net decline.

High volume: households with Children

Life stage has a major impact on buying habits, so it’s no surprise that households with children are more likely to shop online. Compared to other demographics, millennials with children are leading the way at over 15 points above the average and almost 10 points higher than any other group.

“Whether it’s food or non-food, we’re seeing 1 in 10 people who shop online purchase more than half their groceries through digital platforms,” said Nick Sabala, VP of Analytics & Insights – SMARTeamTM Consulting at Advantage Solutions. “Of all the features that make online shopping appealing to families, home delivery is far and away the most important, especially with busy schedules precluding them from shopping anywhere else.”

Knowing that online shoppers are price conscious and less comfortable with their finances than the average shopper, retailers can target these frequent users by offering stock-up promotions. Subscriptions are also a strong way to incentivize repeat purchases since they offer shoppers a discount and the convenience of automation.

Hispanic Shoppers hitting the digital buy button

Hispanics, who tend to be tech savvy and young with larger families, align closely to frequent online buyers in terms of attitude and behavior. Both groups are eating more meals made at home, buying more groceries on sale and stocking up on specific items, especially when the price is right.

Although Hispanics have shopping habits that are typical of other online shoppers, many have different product preferences. Providing recipes with authentic ingredients and flavors is one way to ensure that they don’t switch channels. And Spanish-language marketing materials and the availability of website translation are two ways that retailers can ensure a seamless interaction and reach customers where they are.

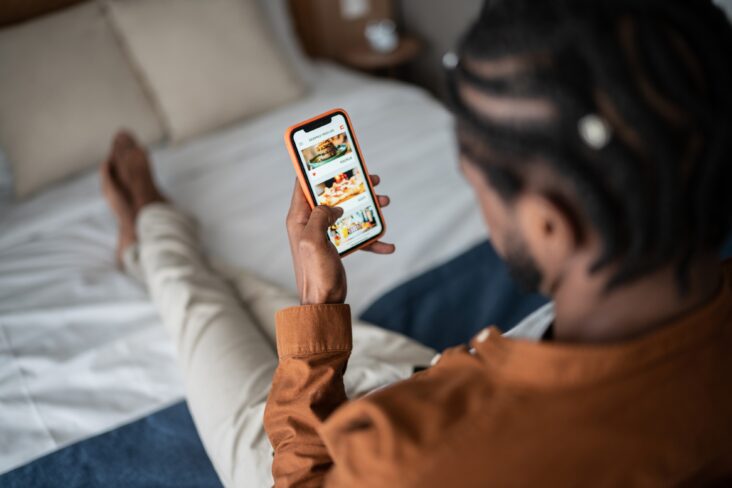

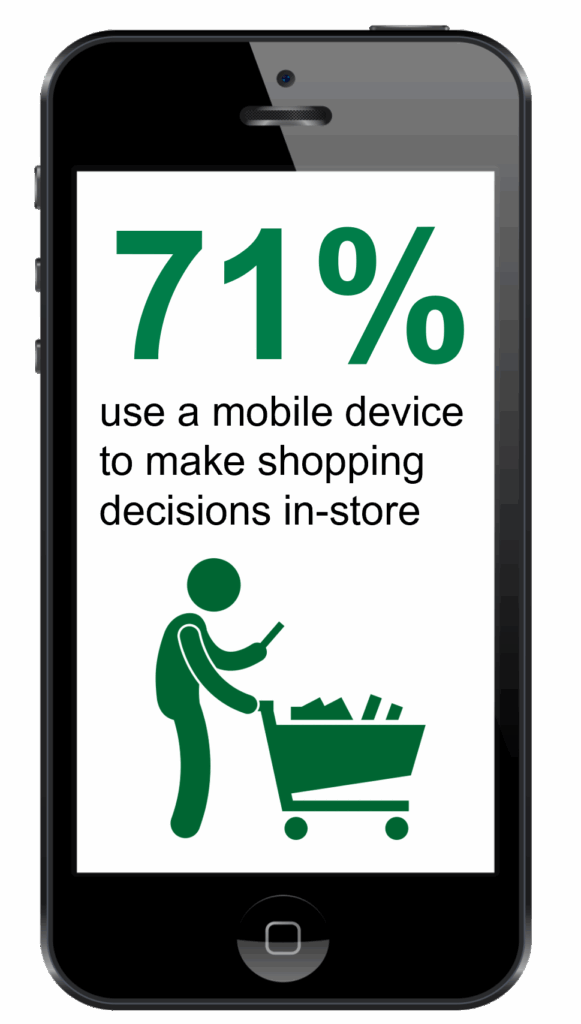

Mobile Devices: The In-store decision engine

Mobile devices have become indispensable for in-store grocery shopping. Over 70% of shoppers take out their phones to make decisions while shopping, but usage varies among generations and life stage. At 92%, Gen Z has the highest usage but even empty nesters, who have the lowest adoption, are still above 50% usage.

With so many shoppers consulting their phones in-store, where are they focusing their attention? Regardless of demographic, store websites and coupons are the most frequent resources. As digital far outpaces physical media, shoppers are increasingly utilizing loyalty apps and digital coupons.

For retailers, offering features like digital shopping lists and price comparison helps shoppers prepare for their trip and easily fill their basket once in store. Rewarding frequent app engagement and earned discounts keeps shoppers interested.

For manufacturers, partnering with retailers who have a strong online sales platform and SEO-focused website increases visibility, especially in food and specialty where online shopping across channels is high.

Convenience, Cost, Consumer Priorities

Digital platforms continue to attract high-volume users, but brick-and-mortar stores aren’t going anywhere soon. As retailers continue to up their game with competitive prices, rewards programs and website resources such as shopping lists and recipes, they’re gradually luring shoppers back—even as the majority of shoppers continue their online buying habits.

For retailers and manufacturers, the path forward lies not in choosing between digital and physical, but in integrating both to meet shoppers where they are. Those investments are creating better outcomes for shoppers while driving loyalty for brands and retailers.

Interested in better understanding the interplay between online shopping and in-store purchases? Download the full Online & Mobile Use report to uncover strategies for winning online shoppers in a shifting market.

For even more context on what drives shopper choice, download these recently published studies from Advantage360TM:

Advantage360TM Manufacturer & Retailer Outlook