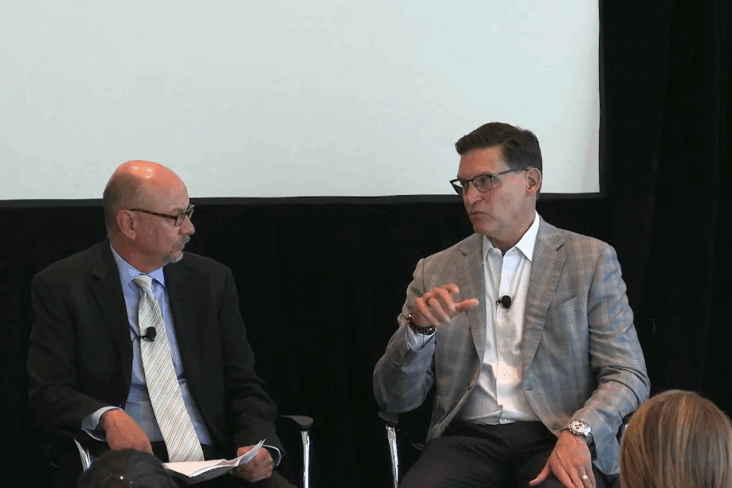

While many companies are grappling with shifting consumer behaviors, Advantage Solutions CEO Dave Peacock laid out how the company is adjusting to uncertainty, transforming for the future and driving sales for less at the recent Canaccord Genuity 45th Annual Growth Conference in Boston.

In front of a live audience, moderated by Canaccord Genuity equity research analyst Joseph Vafi, Peacock provided additional color on Advantage’s second quarter earnings and an outlook for improving growth in the business. He highlighted the company’s ability to deliver faster, more impactful service through tech-enabled analytics, operate more efficiently through workforce optimization and provide greater value to clients and customers by offering interconnected services across the entire path to purchase.

Driving Sales for Less: Transformation and Technology

Over the past two years, Advantage has transformed to be more efficient, responsive and flexible to the needs of its clients.

First, the business was segmented into three groups to provide a sharper focus on clients. Additionally, businesses were sold off to focus on core capabilities and pay down debt. Shared services were centralized and redundancies were identified and eliminated.

With the right foundation in place, Advantage continues to invest in modern tech infrastructure—SAP, cloud migration, data lake, enterprise performance management, cybersecurity—to be largely completed in 2026, which will produce a more efficient and effective organization. Advantage will utilize its modern tech infrastructure to continue elevating the quality and number of its service offerings, bringing value to its clients and customers through a higher return on investment. Additionally, Workday, a human capital management system, is scheduled for go-live in late 2026 and into 2027.

Together, these strategic decisions create a more unified company able to provide interconnected services across the entire path to purchase; enhanced data analytics that power faster, more actionable insights, especially in brokerage services; and more adaptable operations that can flex to provide solutions for any client need.

Opportunities Ahead

Being able to make connections across the entire path to purchase is more important than ever as brands look to build loyalty and retailers want to provide the best experience for shoppers. Divided into three distinctive verticals—Branded Services, Retailer Services, Experiential Services—Peacock describes opportunities for growth and improvement within Advantage specific to each segment:

Branded Services: The new business pipeline remains healthy and it’s anticipated that revenues will start moving towards stabilization by the end of this year and into early 2026. Joint ventures are more than just a fee for service model, providing access to emerging brands and new technology to further enhance the ability to capture new business.

Experiential Services: Direct engagement with a product drives brand loyalty and brand value both in the short- and long-term, generating an attractive return on investment. Product sampling has rebounded to near pre-COVID levels, and with the need to develop brands’ and retailers’ focus on a positive shopping experience, sampling is expected to continue growing at attractive rates. Additional services, such as premium brand activation, store events, subscription boxes and lifestyle sampling, give brands and retailers even more options on how they can connect with shoppers.

Retailer Services: While retailers can often struggle to optimize staffing, Advantage complements in-house teams by providing best-in-class in-store merchandising programs. Retailers continue to signal positive demand for in-store merchandising and many of those retailers also engage Advantage for project work throughout the store. With 85% of retailers prioritizing private brands in response to a shift in channel mix, the company is also well positioned to support retailers through its Daymon business.

“We’re in the business of driving sales for less. We sit between thousands of consumer products companies and manufacturers, and hundreds of retailers,” explained Peacock. “We perform services ranging from selling on behalf of CPGs and optimizing private brand programs for retailers. We do retail merchandising for both CPGs and retailers, and we’re a leading experiential marketing agency.”

Diving into the data lake

AI is an incredibly powerful tool in driving speed and efficiency, but it’s only as good as the data set upon which it’s based. Combining an immense amount of data—from clients, syndicated sources and in-store execution—Advantage created an industry-leading data lake that, in many cases, exceeds that of individual clients due to its breadth.

Using modernized technology to mine these diverse data sources, Advantage can quickly turn unique insights into action, making quick, value-added decisions in the marketplace. From deploying labor in support of clients and selling on their behalf, to ensuring optimized assortments for maximum movement in categories for retailers, the early returns are promising.

Economy of Scale

With over 45,000 frontline teammates delivering 70 million labor hours per year, incremental improvements in workforce efficiency through centralized labor management can drive outsized impact. While AI and streamlined processes are leading to faster hiring as well as more effective onboarding and training, Advantage is also testing moving from a store-based model to a more geographic approach. That way, overall demand for hours can be better managed across a larger footprint.

“One of the challenges I hear when I talk to frontline teammates is that they can’t get enough hours,” Peacock explained. “Higher retention means lower talent acquisition costs and a more tenured workforce so you get greater productivity in the work you’re doing.”

Reducing debt, reaffirming guidance

Since Peacock was appointed CEO, Advantage has voluntarily reduced debt by nearly $350M, bringing the current net debt level to approximately half of what it was in 2019. He reaffirmed that debt repayment remains the priority use of cash while investing in the business for future growth.

“We feel good about the ability to generate cash, especially with a more optimized and tech-enabled business,” Peacock explained. “We feel optimistic about meeting our 2025 guidance as we reaffirmed on our quarterly call.