As the rate of inflation continues to slow, retailers and consumer packaged goods manufacturers are ramping up efforts to appeal to value-conscious shoppers.

Product innovation — for both national brands and private brands — and pricing shifts are leading the way, although the ways in which retailers and manufacturers approach these strategies are markedly different, according to the third-quarter Advantage Outlook, based on a survey of senior-level executives at dozens of leading retailers and consumer products companies across the U.S. (Download the full report here.)

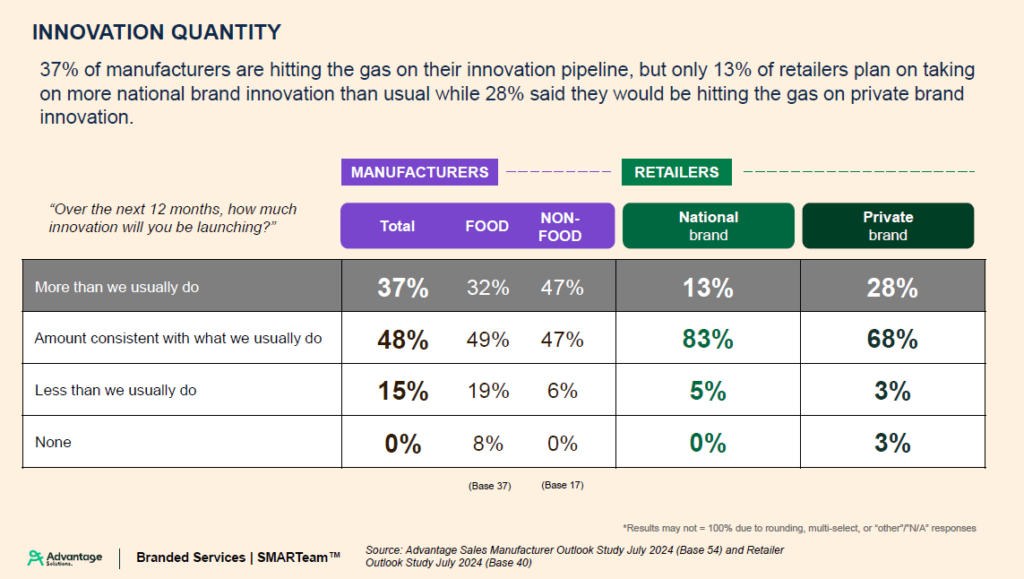

More than one-third of manufacturers (37%) say they are pumping up product innovation over the next 12 months, while only 13% of retailers plan on taking on more national brand innovation than usual. However, more than a quarter of retailers will be hitting the gas on private brand innovation, a continuation of the private brand growth the industry has experienced over the past three years.

Most new products from national brands will target the mainstream and premium price tiers (59% and 37%, respectively) — not the value-priced innovation that retailers would like to see.

“Even if manufacturers aren’t introducing innovations at a value price point, they can still seize opportunities by refining their value proposition for entry-level products while offering innovations at mainstream and premium price points,” says Mona Szumlas, executive vice president, client services at Advantage Solutions, a leading business solutions provider to consumer goods manufacturers and retailers.

“This approach allows manufacturers to meet their objectives while effectively delivering products that meet retailer and consumer needs as well.”

Meeting shoppers’ concerns

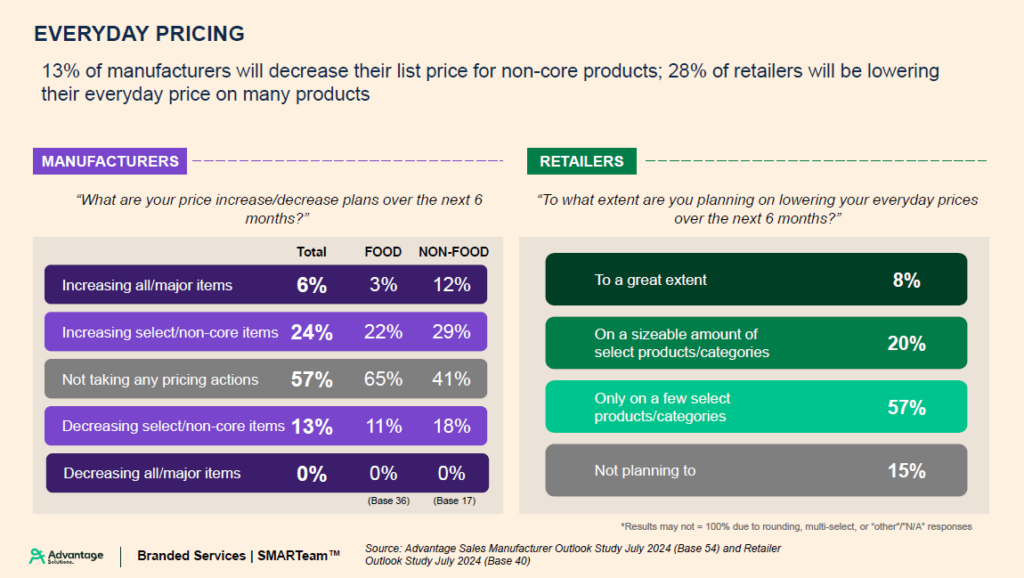

While high prices continue to be the top concern for shoppers, retailers and manufacturers are taking different tacks to address that. Nearly six in 10 manufacturers say they plan no price increases in the next six months, while 13% plan to lower prices on their non-core products. Meanwhile, more than a quarter of retailers plan to lower their everyday prices on a significant number of products.

Szumlas highlights the importance of a well-defined portfolio strategy for manufacturers, emphasizing the need to incorporate tactics to support entry-level price point items.

“Once a brand wins a customer’s loyalty at that entry price, it becomes easier to introduce them to products in higher price tiers,” Szumlas says. “This approach can effectively attract price-sensitive shoppers, build trial and encourage increased foot traffic to retailers. It’s a strategic move to create both consumer engagement and sales opportunities.”

Retailers are also planning to draw more shoppers with their loyalty programs and in-store promotions. Over the next 12 months, retailers will be improving their loyalty offers, including increasing partnership programs and adding more perks, according to the Advantage Outlook report. They’ll also be increasing their use of digital coupons and the frequency of promotions.

“Given how far inflation has gone over the last few years, it has really challenged manufacturers and retailers to take more innovative approaches in the value propositions that they’re presenting to shoppers,” Szumlas says. “We’ll be watching to see how these latest strategies will pay off.”

Making a positive first impression

The retailer focus on private brands is connecting with consumers: According to the latest Private Brand Intelligence Report, 87% of shoppers today say they buy private brands during every typical grocery trip.

On the manufacturer side, 57% of national brand innovation will be line extensions, while almost one quarter will target new categories.

When it comes to evaluating the success of new products, manufacturers think they have more time than retailers do to assess whether a launch is successful or not. Less than half of manufacturers and more than three-quarters of retailers say that new products have a life span of seven to 12 months after launch before they are considered to be underperforming.

That gap between how retailers and manufacturers evaluate new products needs to be addressed, says Szumlas.

“It’s critical for manufacturers and retailers to align on innovation evaluation criteria before new items hit the shelf,” she says. “A successful innovation launch plan should include pre-defined success criteria and contingency plans through the first full year on shelf, and even an exit plan if the new item doesn’t meet expectations.”

The Advantage Outlook is published quarterly and produced in collaboration with Nielsen IQ.

Click here to download your free copy of the Advantage Outlook Q3 2024 report.