Retail is rapidly changing as inflation and tariffs pressure brands, retailers and consumers in different ways. The recently published Advantage360 Manufacturer and Retailer Outlook illustrates the interconnectedness of these three groups and outlines strategies for retailers and manufacturers to get on the same page and stay ahead of evolving consumer demands.

Inflation Nation: ShopPers Seek Value, Retailers Seek Balance

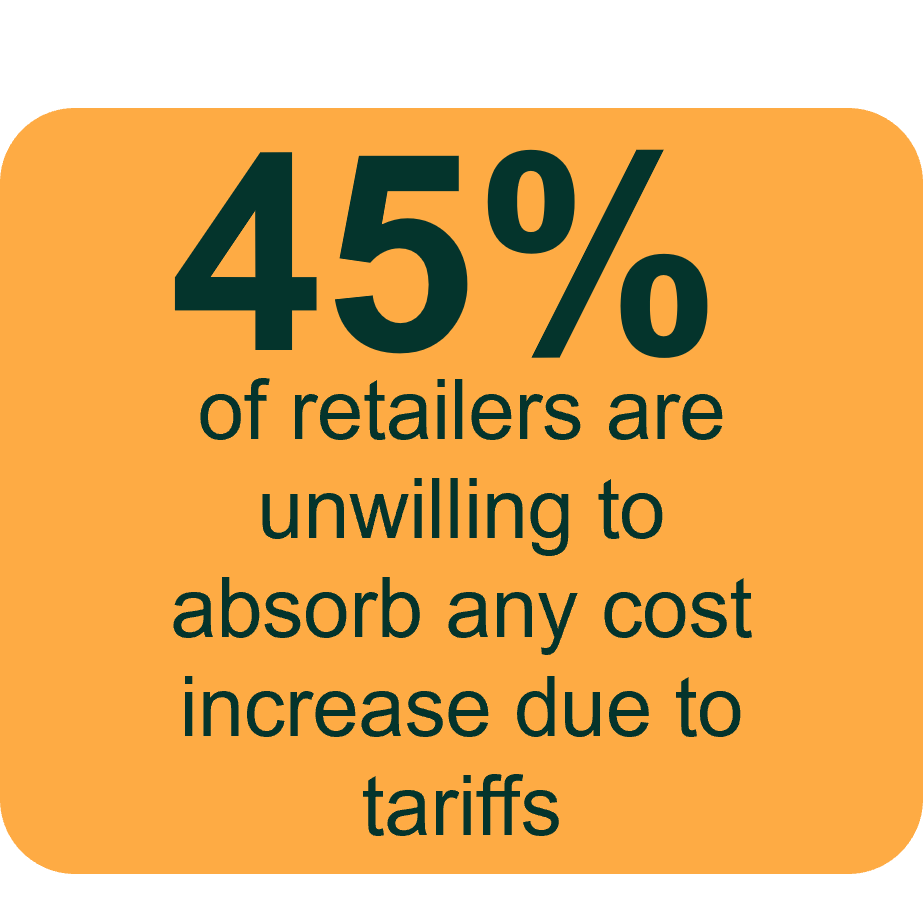

Inflation weighs especially hard on people who frequent mass and discount channels. Retailers are responding by doubling down on affordability and assortment, leaning even further into private brand expansion and delaying price increases on national brand products. At the same time, 90 percent of retailers expect to raise prices due to tariffs, but around half are unwilling to absorb any cost.

CPGs are feeling that pressure differently. Tariffs are impacting their bottom line, but it’s the rising cost of raw materials that are the most concerning to manufacturers. They’re looking to protect margins with smarter trade spend and trimming their marketing budgets in an attempt to offset rising costs.

“We’re seeing a recalibration of value,” says Nico Cattaneo, who leads Enterprise Analytics and Insights at Advantage Solutions. “Shoppers want affordability, but they also expect quality and convenience. Retailers who can deliver both will win.”

GLP-1 is Driving a Health-Conscious Shift

Not all factors driving consumer habits are financial. The rise of GLP-1 medications—used for weight loss and diabetes management—are influencing consumer demand and driving innovation across categories.

Retailers are over twice as likely as CPGs to say that GLP-1 usage will increase demand for healthier/lower calorie options and over three times as likely to anticipate decreased consumption of indulgent/snacking categories. Pasta, baking mixes and other meal ingredients will see the most innovation, along with other categories such as frozen foods, ready-to-drink beverages, salty snacks and breakfast foods.

“GLP-1 is more than a health trend—it’s a category disruptor,” said Nick Sabala, VP of Analytics & Insights – SMART Consulting at Advantage Solutions. “While salty snacks may be trending down in aggregate, think about all the high-quality options and increased volume we see in jerky. More protein, less sugar, less processing and low-fat is a recipe that consumers are asking for across many channels.”

The Retail Media Network Revolution

Sales growth. Customer acquisition. Brand Awareness. All three are important objectives for retail media networks (RMN) according to the Advantage360 Manufacturer and Retailer Outlook, but which one you prioritize depends on how you engage with shoppers.

For manufacturers, sales growth is the name of the game. Although RMNs are not their primary driver of digital marketing spend yet, over half stated it was a key channel with a third indicating they will continue to build out. Brand awareness, which ranked just outside of the top three objectives for manufacturers, was a much higher consideration among food than for non-food.

By contrast, retailers are focused on customer acquisition as their top objective for RMNs, followed by increased basket size. Over half of retailers surveyed also said that they will focus on retail media networks in the next six months in response to shoppers channel shifting to lower-margin retailers.

“Retail media is no longer a nice-to-have—it’s a must-have,” says Katie Rigby, Sr. Director of Analytics & Insights – SMART Consulting at Advantage Solutions. “It’s where brand storytelling meets shopper behavior in real time.”

Channel-Shifting consumers want ease, consistency, innovation

It may seem counterintuitive, but at a time when prices are rising, consumers ranked a stress free trip to the store as a more important consideration than price. Retailers recognize that the shopping experience has the greatest influence on store choice and are making adjustments to attract and keep shoppers. Similarly, retailers have more direct control over product mix than price and are responding by continuing to prioritize private brand for both innovation and value. They are also engaging with shoppers across the spectrum, looking for innovation in the value tier and focusing on premium at the top.

While manufacturers are slower to respond to channel shifting—one in three said they don’t plan to change anything—their strategy mirrors the same pattern as retailers. Manufacturers are prioritizing premium products where higher price points can be justified and expanding lower-priced product lines to keep shoppers from switching channels.

Discover how to win hearts, fill carts and grow your business, despite the market conditions, by downloading a free copy of the Advantage360 Manufacturer & Retailer Outlook.

Learn more with detailed data sets and additional insights in these recently published studies from Advantage360: