Despite easing inflation and low unemployment, value-conscious shoppers continue to shape retail trends this year. They’re hunting for the best deals and seeking product innovation in food and grocery, according to the second-quarter Advantage Outlook.

In response, consumer packaged goods companies and retailers are leaning heavily into promotions and upping their execution on displays, according to the report, a quarterly survey of senior-level executives at dozens of the leading retailers and consumer products companies across the U.S.

“Displays typically give retailers and manufacturers a higher return on investment, but right now, it’s a highly competitive environment, and there’s finite space in each store,” says Jill Blanchard, president of enterprise client solutions at Advantage Solutions.

That has opened up a battleground for those coveted spaces, with CPG companies vying with retailers, which in many cases are prioritizing their own private brands, she says.

Another key takeaway from the survey? Shrinkflation is real. A quarter of CPG companies report they’ve downsized products over the past year while keeping the same price point. Another 20% say they plan to do so in the next year.

This strategy is borne out of rising input costs for manufacturers, which they seek to recover in their price. “It’s essentially a way to take a price increase without really taking a price increase,” Blanchard says.

Nearly three-quarters of CPG manufacturers said their top promotional strategies over the next six months are aimed at driving unit sales, followed closely by the need to compete against other brands (68%). One-third of manufacturers, however, are now using promotions to control everyday price, instead of reducing list price.

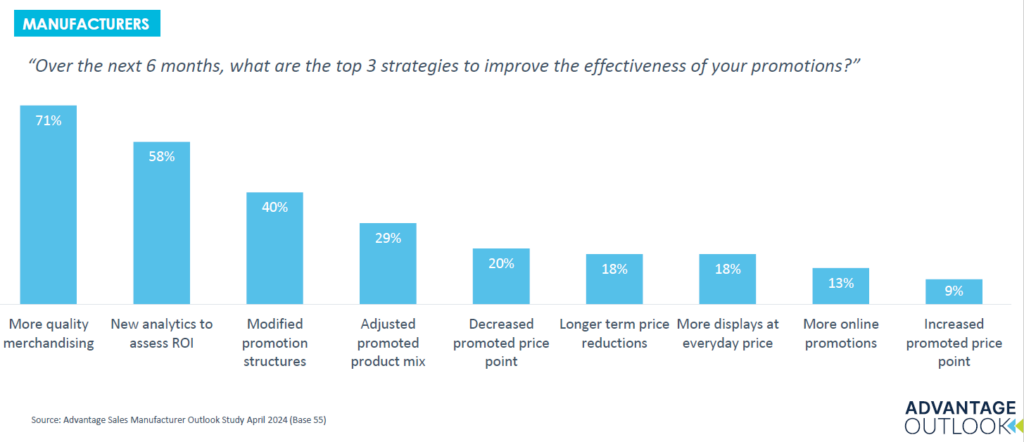

To improve the effectiveness of promotions, manufacturers’ top strategies are to increase features and displays (71%) and use new analytics to assess return on investment (58%), the data show.

Advantage’s teams play a key role in both strategies, Blanchard says. With its advanced analytics capabilities and deep retailer knowledge and relationships, the company gives CPG companies a leg up against their competition for those placements.

Aside from driving unit sales, Blanchard says, “manufacturers’ top reasons for focusing on in-store displays are to highlight lower prices and generate new sales at regular price.”

Similarly, retailers’ top strategy to grow baskets is to invest in promotional prices. To increase store trips, they plan to focus on reward programs, everyday price and at-shelf promotions.

Innovation is back

After a slowdown precipitated by the pandemic, innovation is ramping back up in part driven by retailers’ need to differentiate themselves from competitors at shelf to draw more consumers into their stores and keep them there.

Consumer appetite for new items continues unabated, and retailers are delivering, Blanchard says. A key focus is increasing innovation with private brands, with 26% of retailers saying they plan to do so “by a lot” over the next six months, the survey shows.

“This is all about meeting the value-conscious consumer where they’re at,” she says. “And that’s going to make the space more competitive for national brands.”

On top of that, more than three-quarters of retailers say they plan to execute more test-and-learns, again in an effort to bring new shoppers into their stores and prevent leakage to lower-cost rivals, she says. Innovation is also proving to deliver unit volume growth, with 61% of the 2022 new products on shelf today delivering positive unit volume growth.

Channel shifting and online growth

Consumer channel shifting also remains a front-and-center topic, pushing manufacturers and retailers to implement new strategies to respond.

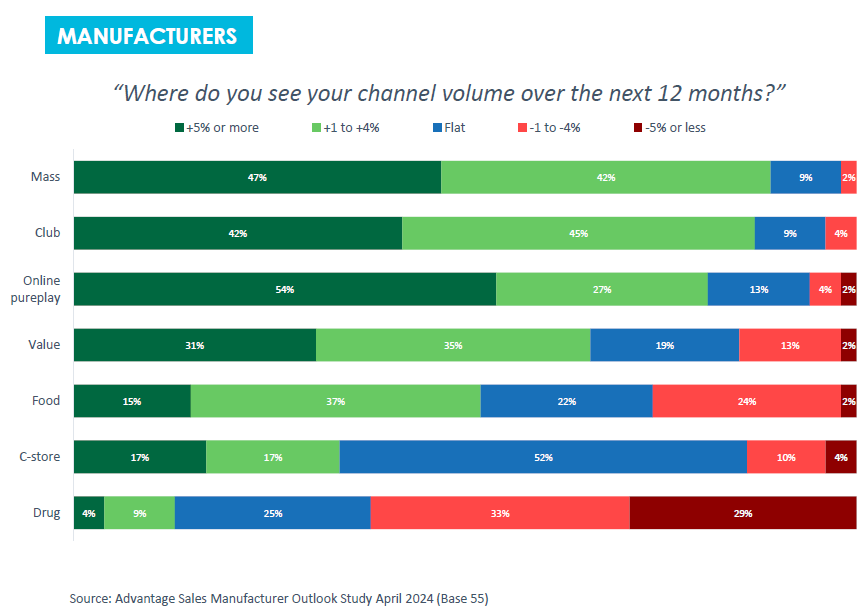

“Manufacturers see the biggest channel volume drivers over the next year to be online pure play, mass and club,” says Blanchard. “While most manufacturers are not shifting inventory or people in response to the volume shift to lower-margin retailers, we do see two-thirds of manufacturers shifting trade funds and marketing support.”

About half of retailers, meanwhile, are planning to shift in-store labor to online fulfillment over the next six months in response to an expected rise in online sales.

Here are some other highlights from the Advantage Outlook:

- Retailers’ top private-brand strategies over the next six months are increasing displays, increased facings and adding new items.

- To address theft, retailers say their top strategies are to increase video surveillance and discontinue high-shrink products.

- About half of manufacturers have rolled out smaller and larger pack sizes of products in the past 12 months; an equal amount plan to roll out new smaller and larger sizes over the next year.

- Two-thirds of manufacturers are not planning any list price changes; one in four plan to make price increases on select or non-core items.

The Advantage Outlook is published quarterly and produced in collaboration with Nielsen IQ.